Imagine waking up to find your bank account has grown while you slept. That’s the power of passive income – money earned with minimal ongoing effort. Unlike your day job, passive income doesn’t demand your constant attention, yet it can provide financial security, freedom, and the ability to build wealth over time.

I’ve spent years researching and testing various passive income strategies, separating the practical from the pipe dreams. In this guide, I’ll share 15 legitimate passive income ideas that actually work in the real world, complete with realistic expectations about earnings, time investment, and what it takes to succeed.

What Is Passive Income?

Passive income is money earned with minimal daily involvement. Unlike active income from a job or business that requires your constant time and effort, passive income continues to flow after the initial setup work is complete.

It’s important to understand that “passive” doesn’t mean “no effort.” Most passive income streams require a significant upfront investment – either time, money, skills, or a combination of these. The “passive” part comes later, when your assets begin generating income with minimal ongoing maintenance.

The key to successful passive income isn’t finding a get-rich-quick scheme – it’s creating or investing in assets that continue to provide value and generate returns long after your initial work is done.

Let’s explore 15 proven passive income ideas, grouped by the type of investment they require, so you can find options that align with your resources and goals.

Investment-Based Passive Income Ideas

These strategies require financial capital but minimal ongoing time commitment. They’re ideal if you have savings to invest and want truly passive income streams.

1. Dividend Stocks

Dividend stocks are shares in companies that distribute a portion of their earnings to shareholders on a regular basis, typically on a quarterly basis. Companies with long histories of dividend payments and increases (known as “Dividend Aristocrats”) are particularly attractive for passive income investors.

How It Works:

You purchase shares of dividend-paying companies through a brokerage account. As a shareholder, you receive regular dividend payments either as cash or reinvested to buy more shares (compounding your returns).

Potential Earnings: 2-5% annual yield, with potential for capital appreciation

Time Investment: Initial research to select quality stocks, then quarterly review of portfolio performance

Advantages

Disadvantages

To get started, open an account with a reputable broker, such as Fidelity or Vanguard, and consider starting with a dividend ETF for instant diversification.

2. Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-producing real estate across various sectors (residential, commercial, healthcare, etc.). They’re required by law to distribute at least 90% of their taxable income to shareholders as dividends.

How It Works:

You purchase shares of publicly-traded REITs through a brokerage account, similar to buying stocks. The REIT manages the properties and distributes rental income and profits from property sales to shareholders.

Potential Earnings: 3-8% annual dividend yield

Time Investment: Initial research to select quality REITs, then quarterly portfolio review

Advantages

Disadvantages

Popular REIT platforms include Fundrise (starting at $10) and publicly traded REITs through any brokerage.

3. High-Yield Savings Accounts and CDs

While not the most exciting option, high-yield savings accounts and certificates of deposit (CDs) offer virtually risk-free passive income through interest payments. They’re perfect for emergency funds or short-term savings goals.

How It Works:

Deposit money into FDIC-insured high-yield savings accounts or CDs at banks or credit unions. Your money earns interest at a fixed or variable rate.

Potential Earnings: 3-5% annual percentage yield (APY) in the current rate environment

Time Investment: Minimal – just account setup and occasional rate comparison

Advantages

Disadvantages

Online banks, such as Ally and Marcus by Goldman Sachs, typically offer higher interest rates than traditional brick-and-mortar banks.

Digital Product Passive Income Ideas

These strategies leverage your knowledge and creativity to create digital assets that can be sold repeatedly with minimal ongoing effort.

4. Online Courses

If you have expertise in a particular subject, creating and selling online courses can generate substantial passive income. Once created, the same course can be sold thousands of times with minimal additional work.

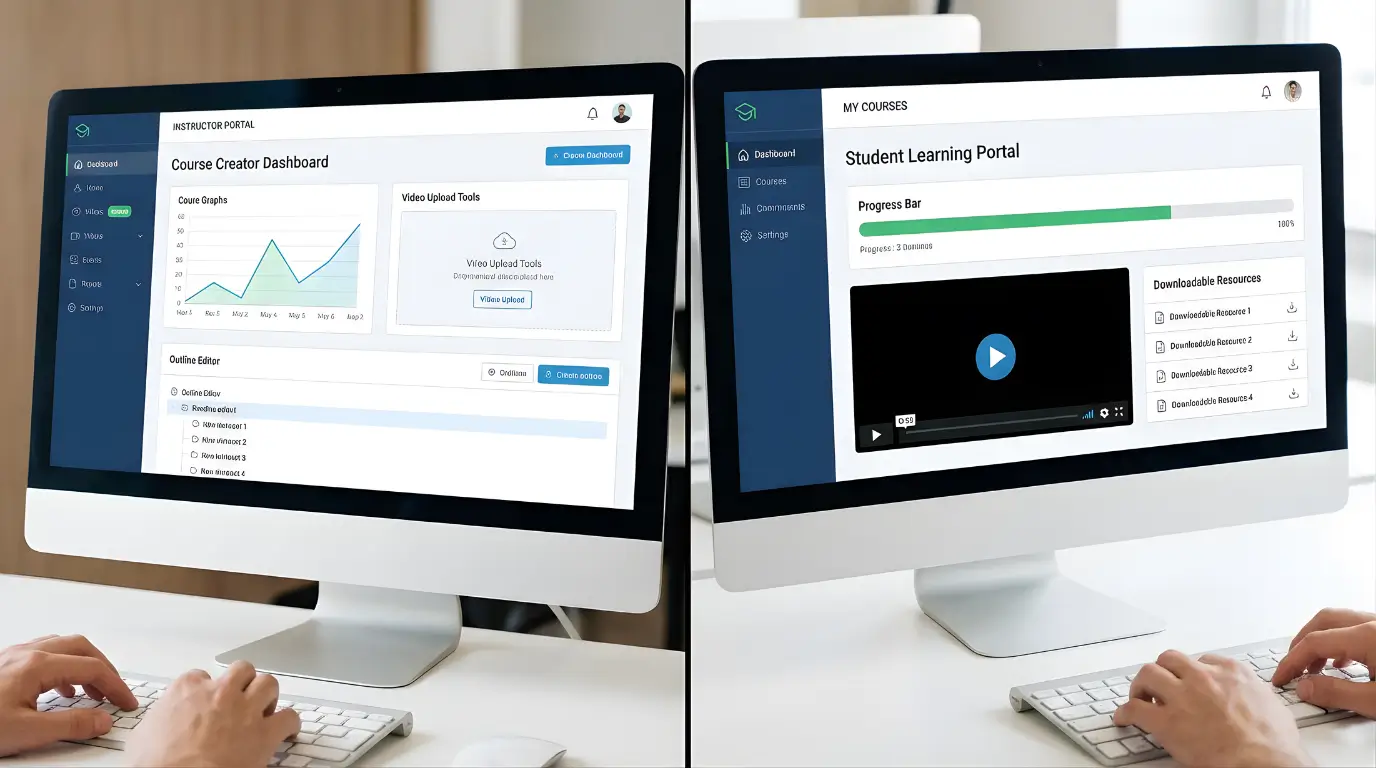

How It Works:

Develop a curriculum, record video lessons, create supporting materials, and host your course on platforms like Udemy, Teachable, or Thinkific. Students purchase access to your pre-recorded content.

Potential Earnings: $500-$10,000+ monthly (highly variable).

Time Investment: 40-100+ hours for course creation, then 2-5 hours monthly for updates and student support.

Advantages

Disadvantages

Popular platforms include Udemy (marketplace model) and Teachable (host your own school).

5. E-books and Digital Products

Creating and selling e-books, templates, printables, or other digital products requires upfront effort but can generate passive income for years to come. Digital products have virtually no reproduction costs, making them highly profitable.

How It Works:

Create valuable digital content, set up an online storefront or use existing marketplaces, and automate the delivery process. Customers purchase and download your products without your direct involvement.

Potential Earnings: $200-$5,000+ monthly.

Time Investment: 20-100 hours for product creation, then 2-5 hours monthly for updates and customer support.

Advantages

Disadvantages

Platforms like Etsy, Amazon KDP, and Gumroad make it easy to sell digital products.

6. Affiliate Marketing

Affiliate marketing involves promoting other companies’ products and earning a commission for each sale made through your unique referral link. It’s particularly effective when combined with content creation, such as blogging or YouTube.

How It Works:

Create valuable content that naturally incorporates product recommendations. Include your affiliate links, and when readers purchase through those links, you earn a percentage of the sale.

Potential Earnings: $100-$10,000+ monthly.

Time Investment: 10-20 hours weekly for content creation initially, decreasing as your content library grows.

Advantages

Disadvantages

Popular affiliate programs include Amazon Associates, ShareASale, and ClickBank.

Create Your Digital Income Stream

Get started with platforms that make it easy to sell your knowledge and digital creations.

Content-Based Passive Income Ideas

These strategies involve creating content that continues to generate revenue through ads, sponsorships, or other monetization methods.

7. YouTube Channel

Creating a YouTube channel allows you to earn passive income through ad revenue, sponsorships, affiliate marketing, and merchandise sales. While building a successful channel requires consistent effort initially, popular videos can continue generating income for years.

How It Works:

Create and upload valuable video content to YouTube. Once you meet the requirements (1,000 subscribers and 4,000 watch hours), you can monetize your channel through the YouTube Partner Program and earn from ads shown on your videos.

Potential Earnings: $0.5-$10 per 1,000 views (plus sponsorships and affiliate income).

Time Investment: 10-40 hours per video initially, decreasing as you develop systems

Advantages

Disadvantages

Get started with YouTube Creator Academy for free training on building a successful channel.

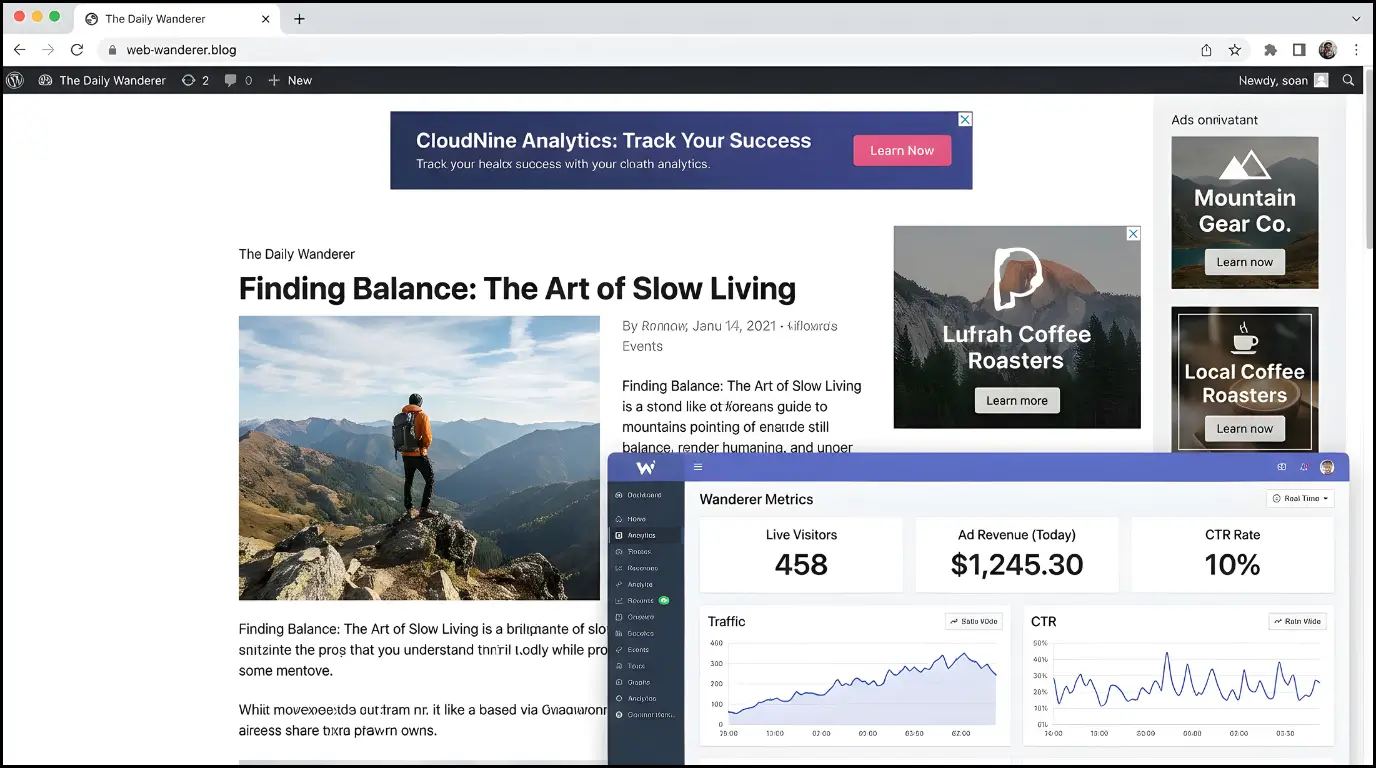

8. Blogging with Display Advertising

Creating a blog on topics you’re knowledgeable about can generate passive income through display advertising, affiliate marketing, and sponsored content. Once published, articles can continue to attract traffic and generate revenue for years.

How It Works:

Build a website, create valuable content optimized for search engines, and monetize with ad networks like Google AdSense, Mediavine, or AdThrive. Visitors to your site generate ad impressions and clicks, earning you revenue.

Potential Earnings: $5-$30+ per 1,000 pageviews (depending on niche and ad network)

Time Investment: 10-20 hours per week for 6-12 months, then 5-10 hours weekly for maintenance

Advantages

Disadvantages

Start with WordPress for your blog platform and Google AdSense for initial monetization.

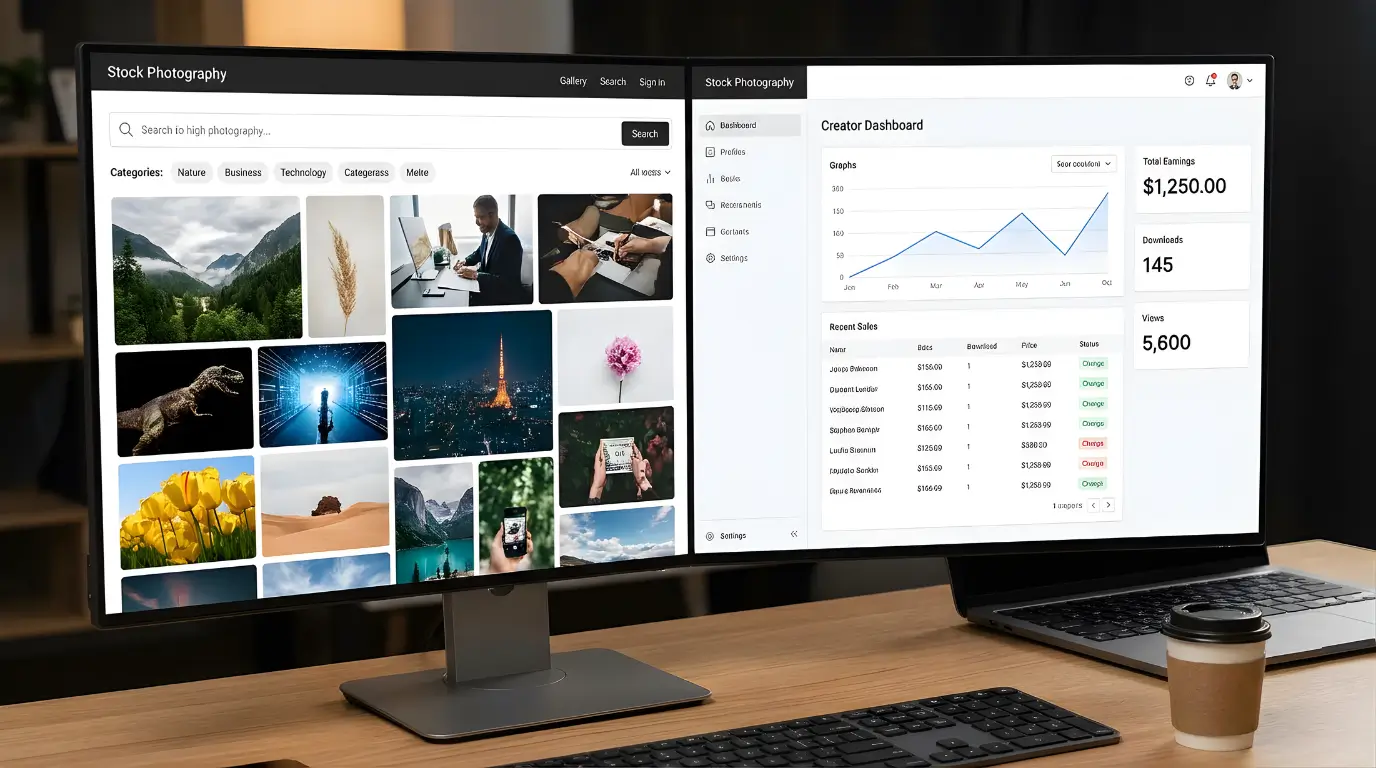

9. Stock Photography

If you have photography skills, selling your images on stock photo websites can create a passive income stream that continues paying as customers download your work.

How It Works:

Take high-quality photos, edit them, and upload them to stock photography platforms. When customers purchase or license your images, you receive a royalty payment.

Potential Earnings: $0.25-$2 per download (varies by platform and license type)

Time Investment: 10-20 hours to create and upload initial portfolio, then ongoing uploads as desired.

Advantages

Disadvantages

Popular platforms include Shutterstock, Adobe Stock, and Getty Images.

Rental-Based Passive Income Ideas

These strategies involve renting out assets you own to generate ongoing income.

10. Rental Properties

Real estate remains one of the most proven paths to wealth creation. Rental properties can provide both ongoing income and long-term appreciation, especially when managed properly.

How It Works:

Purchase residential or commercial property and rent it to tenants. The rental income covers your mortgage, expenses, and ideally provides additional cash flow. A property manager can handle day-to-day operations to make this truly passive.

Potential Earnings: 5-10% annual cash-on-cash return, plus appreciation

Time Investment: 5-10 hours monthly if self-managed, 1-2 hours if using property management

Advantages

Disadvantages

Consider using BiggerPockets for education and Zillow for property research.

11. Short-Term Rentals

Platforms like Airbnb and VRBO have made it easier than ever to rent out your property on a short-term basis, often generating more income than traditional long-term rentals.

How It Works:

List your property (or even just a spare room) on short-term rental platforms. Guests book for days or weeks at a time, often paying premium rates compared to long-term rentals.

Potential Earnings: 1.5-2.5x the income of long-term rentals (location dependent).

Time Investment: 5-15 hours monthly for guest communication and coordination, less with co-hosts or management services.

Advantages

Disadvantages

Get started with Airbnb or VRBO hosting.

12. Rent Out Assets

You can generate passive income by renting out assets you already own but don’t use on a full-time basis, such as vehicles, equipment, or storage space.

How It Works:

List your underutilized assets on peer-to-peer rental platforms. Others pay to use your items when you’re not using them, with the platform handling bookings and payments.

Potential Earnings: Varies widely by asset type:

Time Investment: 2-5 hours monthly for coordination and maintenance

Advantages

Disadvantages

Popular platforms include Turo for cars, RVShare for RVs, and Neighbor for storage space.

Automated Business Passive Income Ideas

These strategies involve setting up businesses that can operate with minimal day-to-day involvement.

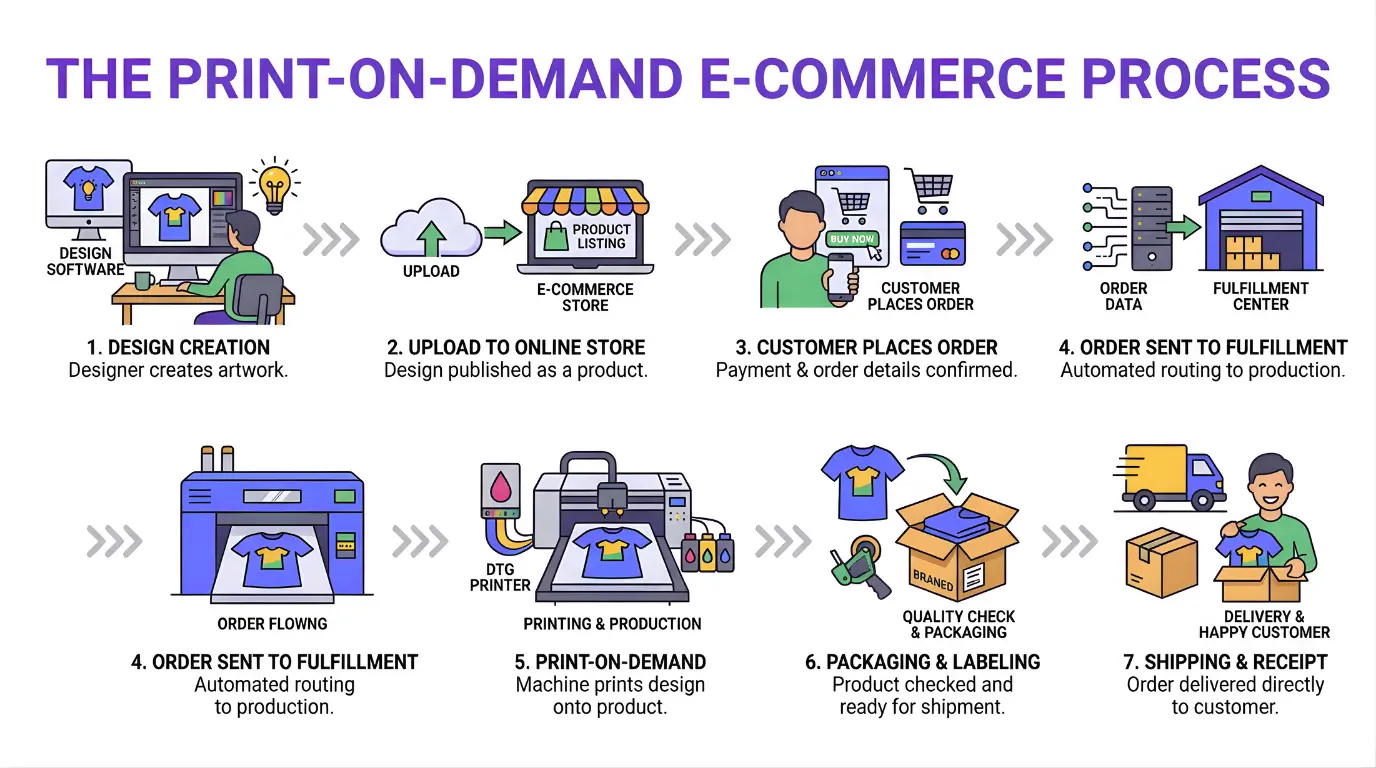

13. Print-on-Demand Products

Print-on-demand allows you to sell custom-designed products without the need for inventory, manufacturing equipment, or shipping logistics. Products are created only when ordered and shipped directly to customers.

How It Works:

Create designs and upload them to print-on-demand platforms. When customers order, the platform prints your design on the selected product, ships it directly to the customer, and pays you the profit margin.

Potential Earnings: $200-$3,000+ monthly

Time Investment: 20-40 hours for initial setup and designs, then 5-10 hours monthly for new designs and marketing

Advantages

Disadvantages

Popular platforms include Printful, Printify, and Redbubble.

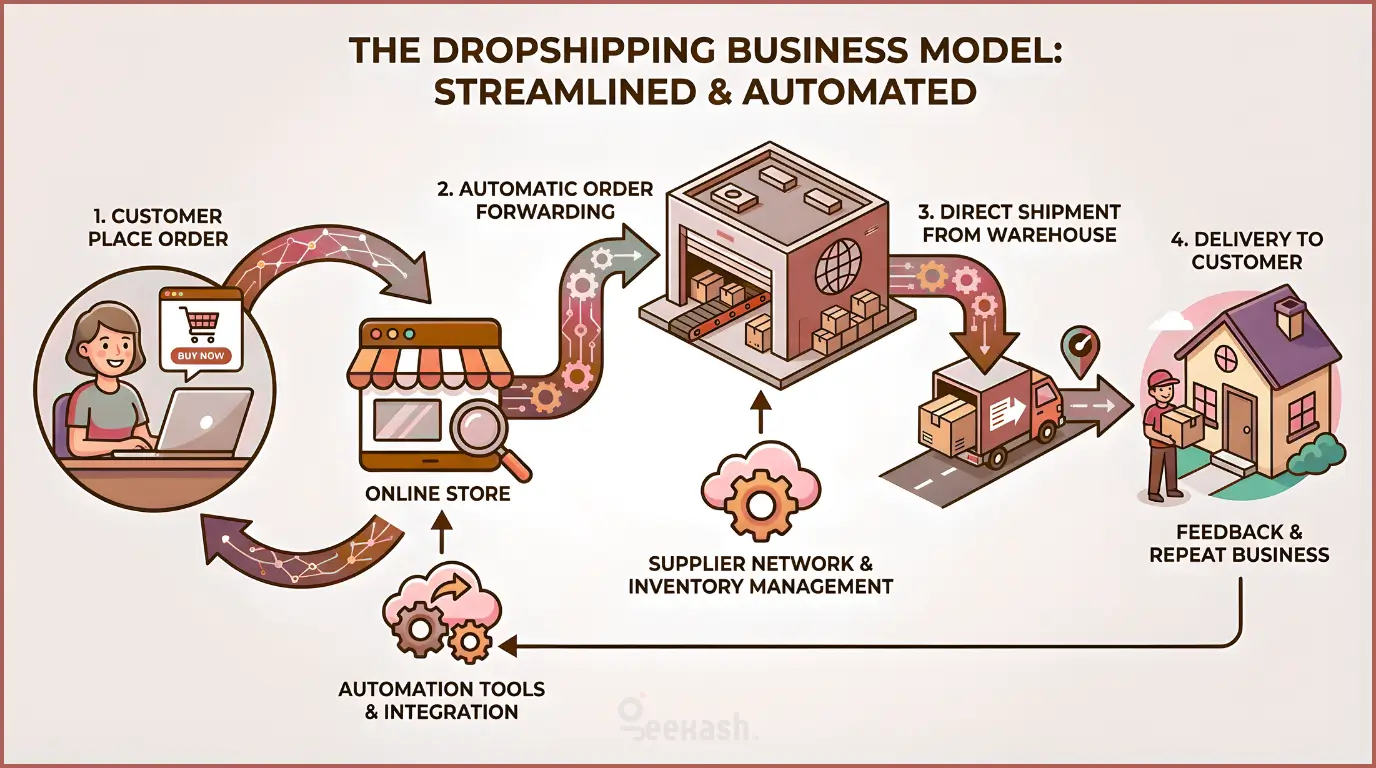

14. Automated Dropshipping

Dropshipping allows you to sell products online without handling inventory. When customers place orders, your suppliers ship products directly to them, creating a hands-off business model.

How It Works:

Set up an online store, list products from dropshipping suppliers, and market your store. When customers place an order, you forward it to your supplier, who handles fulfillment, and you retain the profit margin.

Potential Earnings: $500-$10,000+ monthly.

Time Investment: 40-80 hours for store setup, followed by 10-20 hours of work weekly initially, decreasing with automation.

Advantages

Disadvantages

Get started with Shopify and apps like Oberlo or DSers.

15. Vending Machines

Vending machines can provide truly passive income once established. Modern machines with cashless payment options and remote monitoring make this traditional business more hands-off than ever.

How It Works:

Purchase vending machines, secure locations with high foot traffic, stock with products, and collect revenue. Remote monitoring systems alert you when restocking is needed or when issues arise.

Potential Earnings: $100-$500+ monthly per machine.

Time Investment: 5-10 hours monthly per machine for restocking and maintenance.

Advantages

Disadvantages

Research suppliers through Vending Connection and Google search for cashless payment systems.

How to Choose the Right Passive Income Strategy

With so many passive income options available, how do you choose the right one for your situation? Consider these factors:

Available Resources

Income Goals

Personal Preferences

The best passive income strategy is one that aligns with your resources, goals, and preferences. Start with one method, master it, and then diversify into additional streams over time.

Pro Tip

Rather than trying to launch multiple passive income streams simultaneously, focus on one strategy that best matches your current situation. Once it’s generating consistent income, use those earnings to fund additional passive income ventures.

Conclusion

Building passive income takes time, effort, and often some upfront investment. The key is to start now and be consistent. Here’s a simple framework to begin your passive income journey:

- Assess your resources: Take inventory of your available time, money, skills, and interests.

- Choose one strategy: Select the passive income idea that best aligns with your current situation.

- Set realistic expectations: Understand that most passive income streams typically take months or years to fully develop.

- Create an action plan: Break down the process into manageable steps with specific deadlines.

- Execute consistently: Put in the work required to build your passive income stream.

- Monitor and optimize: Track your results and make adjustments to improve performance.

- Reinvest and expand: Use your earnings to grow your existing stream or develop new ones.

Remember that the most successful passive income earners typically have multiple streams working simultaneously. Start with one, master it, and then expand your portfolio over time.

Financial freedom doesn’t happen overnight, but with consistent effort and the right passive income strategies, you can build wealth that works for you—not the other way around. The best time to start was yesterday. The second-best time is today.